The Ultimate Housing Hack: How to Negotiate a 2-1 Rate Buydown

In today’s real estate market, buyers are facing a classic "catch-22." Inventory is finally starting to move, but mortgage rates are still high enough to make the average monthly payment feel like a secondary tax. Many buyers are sitting on the sidelines, waiting for the Federal Reserve to pivot or for a housing "crash" that may never come.

But what if you could travel back in time and snag a mortgage rate from two years ago?

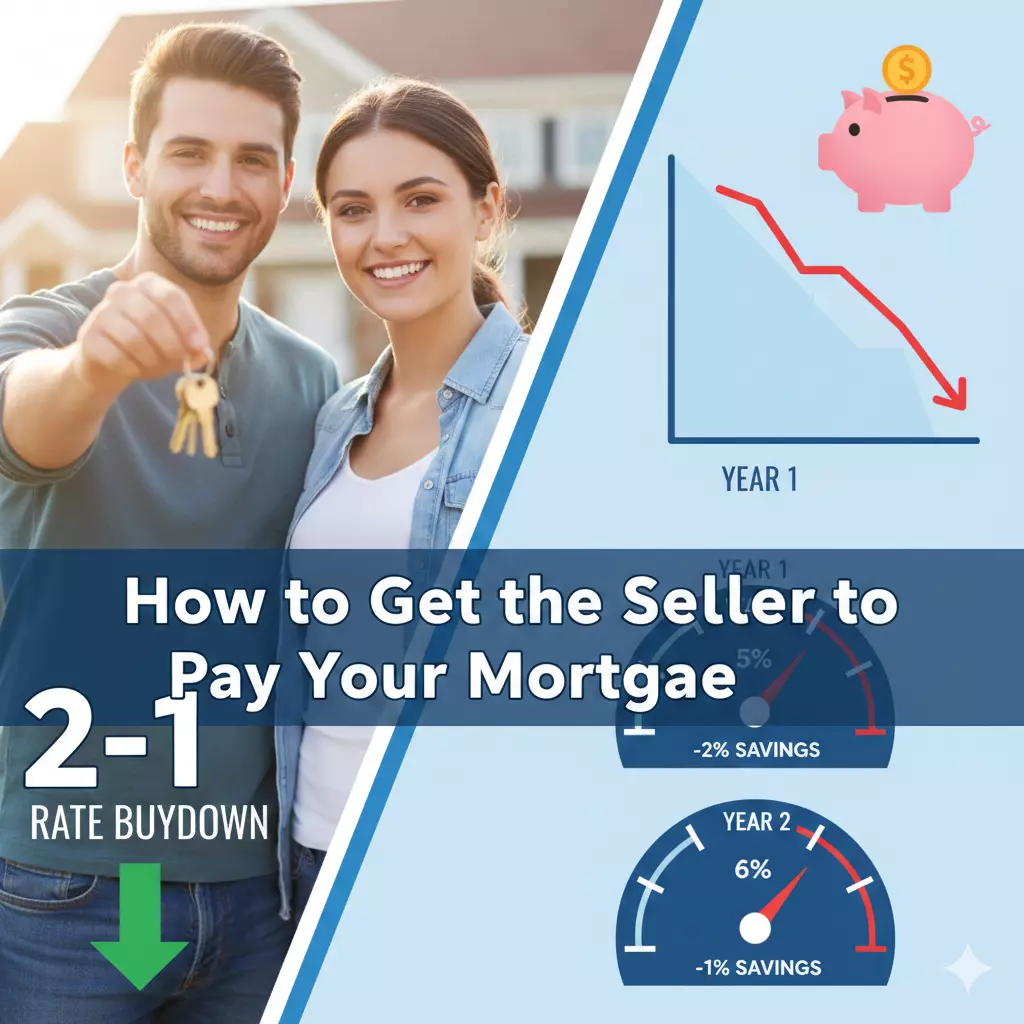

Enter the 2-1 Rate Buydown. This is arguably the most powerful negotiation tool in a buyer’s arsenal today. It allows you to ease into your mortgage with significantly lower payments, funded entirely by the seller. Here is everything you need to know about how it works and how to negotiate one.

What is a 2-1 Buydown?

A 2-1 buydown is a type of mortgage financing that lowers your interest rate for the first two years of the loan. It’s not a permanent reduction, but rather a "temporary subsidy" paid for at closing.

The breakdown is simple:

-

Year 1: Your interest rate is 2% lower than the locked-in market rate.

-

Year 2: Your interest rate is 1% lower than the market rate.

-

Year 3 through 30: The rate moves to the full note rate you originally locked in.

For example, if you qualify for a 7% interest rate, a 2-1 buydown means you pay 5% in the first year, 6% in the second year, and 7% for the remainder of the loan.

The Math: Real Savings in Your Pocket

To understand why this is a game-changer, let’s look at a $400,000 mortgage.

At a standard 7% interest rate, your principal and interest payment is roughly $2,661. With a 2-1 buydown:

-

Year 1 (at 5%): Your payment drops to $2,147. You save $514 every month.

-

Year 2 (at 6%): Your payment is $2,398. You save $263 every month.

Total savings over two years? $9,324. That is nearly ten thousand dollars that stays in your bank account while you are buying furniture, painting walls, and adjusting to homeownership.

Why Sellers Love It (And Why They’ll Say Yes)

You might be wondering: “Why would a seller give me $10,000?” In a cooling market, sellers often get desperate. Their first instinct is usually to drop the asking price. However, a $10,000 price reduction on a $400,000 home barely moves the needle for a buyer—it might lower the monthly payment by only $60 or $70.

But if the seller takes that same $10,000 and applies it toward a 2-1 Rate Buydown, they provide the buyer with $500+ in monthly savings. For the seller, the cost is the same. For the buyer, the "purchasing power" and monthly relief are nearly ten times more effective. It allows the seller to keep their high asking price (which helps the neighborhood's comparable sales) while offering a massive incentive to the buyer.

How to Negotiate the Deal

If you want to land a 2-1 buydown, you have to be strategic with your offer. Here is the step-by-step roadmap:

1. Talk to Your Lender First

Not every loan program allows for a temporary buydown. Ensure your lender offers it and ask them for a "Buydown Calculation" sheet. This will show you exactly how much the seller needs to contribute to cover the cost.

2. Frame it as a "Seller Credit"

When you submit your purchase offer, don’t just ask for a lower price. Instead, offer closer to the asking price but include a contingency for Seller Concessions. Your offer should specify that the seller will contribute $X towards your "closing costs and prepaids."

3. Explain the "Why"

If the seller is hesitant, have your agent explain that this credit makes the home more affordable for you without them having to slash the listing price for the whole world to see. It’s a "quiet" way to make a deal happen.

The "Refinance" Safety Net

The biggest fear buyers have with a 2-1 buydown is Year 3. “What if I can’t afford the full rate?”

The beauty of this strategy is flexibility. Most 2-1 buydowns are structured so that the "unused" subsidy money is held in an escrow account. If interest rates drop in 12 or 18 months and you decide to refinance into a permanently lower rate, many lenders will apply the remaining balance of that seller credit toward your principal reduction.

You aren't "losing" the money; you’re just using it as a bridge to get to a better market.

While a 2-1 buydown is a fantastic tool for many, it isn't a "free lunch." It is a financial maneuver that comes with specific risks and trade-offs that you need to consider before signing the closing papers.

Here are the primary disadvantages of a mortgage buydown:

1. The "Payment Shock" Risk

The most significant disadvantage is the inevitable jump in monthly costs. Because the low rate is temporary, you will experience two scheduled "pay raises" for your mortgage. If your income doesn't increase or if you haven't budgeted for the Year 3 reality, the jump from a 5% rate to a 7% rate (on a $400,000 loan) can be an extra $500+ per month. This can lead to significant financial strain if you aren't prepared.

2. Potential Overpayment for the Home

Sellers are usually only willing to fund a buydown if you offer them a higher purchase price. You might be so focused on the low monthly payment that you agree to pay full asking price (or more) for a home that might actually be worth less. If the market dips, you could find yourself "underwater"—owing more on the mortgage than the home is worth—making it impossible to sell or refinance.

3. Refinance Uncertainty

The 2-1 buydown is often sold as a "bridge" to a future refinance. The logic is: "Don't worry about the Year 3 rate; you'll just refinance when rates drop!" However, there are two major risks here:

-

Rates may stay high: There is no guarantee that market rates will be lower in two years.

-

Home value may drop: To refinance, you typically need at least 3% to 5% equity. If your home’s value stays flat or decreases, you won't be able to refinance regardless of how low the market rates go.

4. Opportunity Cost of the Credit

The money used for the buydown is a "seller concession." You generally have a limit on how much a seller can contribute (often 3% to 6% of the loan amount). By using that credit for a temporary rate drop, you are giving up the chance to use that money for:

-

Permanent Buydown: Buying "points" to lower the rate for the full 30 years.

-

Closing Costs: Using the credit to cover taxes and fees, keeping more cash in your pocket at closing.

-

Price Reduction: Lowering the total amount you owe on the home.

5. Qualification is Still Based on the High Rate

Even though you only pay the 5% rate in Year 1, the bank still qualifies you based on the full note rate (7%). This means a buydown won't help you "afford" a more expensive house than you normally would; you still have to prove to the lender that you can handle the highest possible payment.

6. Complexity and Availability

Temporary buydowns aren't available for every loan type. They are common for Conventional and FHA loans, but harder to find for Jumbo loans or certain investment properties. Furthermore, not all lenders offer them, which might limit your ability to shop around for the best overall loan terms.

Summary Table: Temporary Buydown Trade-offs

| Feature | The Catch |

| Lower Payments | Only lasts 24 months. |

| Seller Funded | Usually requires a higher purchase price. |

| Refinance Option | Requires the home to maintain or gain value. |

| Budgeting | Requires "forced" savings to prepare for Year 3. |

Final Thoughts

The 2-1 Rate Buydown is the ultimate "marry the house, date the rate" strategy. It gives you the immediate breathing room of a low payment while allowing you to secure the home you want today. In a market where every dollar counts, don't just negotiate on price—negotiate on the cost of your money.

Recent Posts