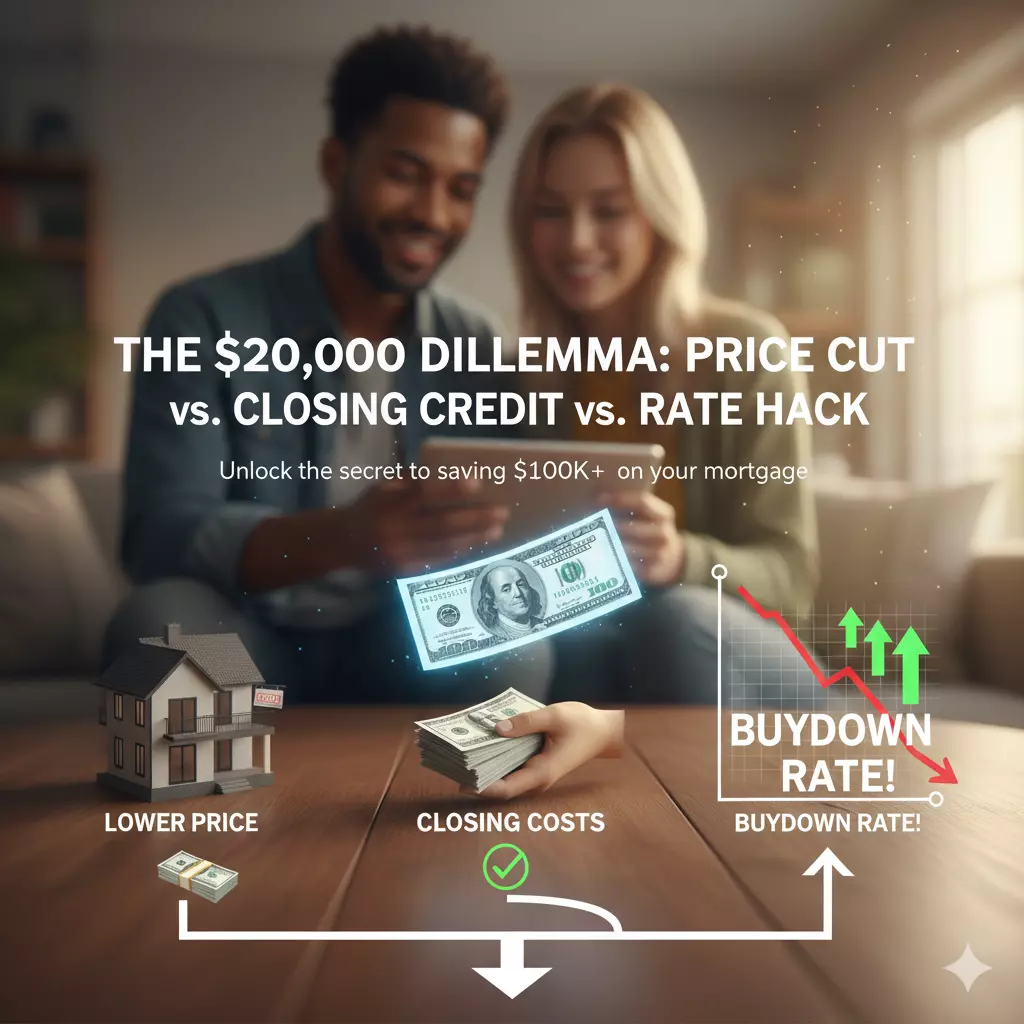

The $500,000 Dilemma: Price Drop vs. Closing Cost Credit and Rate Buydowns

Scenario 1: Lowering the Listing Price by $20,000

In this scenario, you're offering $480,000 for the $500,000 house.

Pros:

-

Lower Monthly Mortgage Payments: This is perhaps the most immediate and significant benefit. A lower principal balance means less interest paid over the life of the loan and a smaller monthly payment.

-

Numeric Example:

-

Original Loan ($500,000): Assuming a 30-year fixed mortgage at 7% interest, your principal and interest payment would be approximately $3,326 per month.

-

Reduced Loan ($480,000): With the same terms, your principal and interest payment would drop to approximately $3,193 per month.

-

Savings: That's a direct saving of $133 per month, or $1,596 per year. Over 30 years, this adds up to a substantial $47,880 in interest savings alone!

-

-

-

Reduced Property Taxes (Potentially): While not always a direct one-to-one correlation, property taxes are often assessed based on the home's value. A lower purchase price could lead to a slightly lower tax assessment, saving you money annually.

-

Numeric Example: If property taxes are assessed at 1.5% of the home's value, a $20,000 reduction in price could mean a $300 annual saving in property taxes (1.5% of $20,000).

-

-

Increased Equity from Day One: By paying less for the house, you essentially have more equity built in from the moment you close. This can be a strong position if the market experiences a slight downturn or if you need to refinance in the future.

-

Better Loan-to-Value (LTV) Ratio: A lower purchase price, assuming your down payment remains the same, will result in a better LTV ratio. This can sometimes lead to more favorable loan terms or a lower PMI (Private Mortgage Insurance) if you're putting down less than 20%.

Cons:

-

Slightly Higher Upfront Costs (for closing): While your loan amount is lower, your closing costs (which we'll discuss in more detail shortly) remain largely the same. This means you still need to bring the full amount of those costs to the table.

Scenario 2: A $20,000 Concession on Closing Costs

In this scenario, you're still agreeing to the $500,000 purchase price, but the sellers are crediting you $20,000 towards your closing costs.

Pros:

-

Significantly Reduced Upfront Cash Outlay: This is the primary and most attractive benefit of a closing cost credit. Closing costs can be a substantial sum, often ranging from 2% to 5% of the loan amount. For a $500,000 home, this could be anywhere from $10,000 to $25,000. A $20,000 credit can dramatically reduce the cash you need to bring to the closing table.

-

Numeric Example:

-

Let's assume your total closing costs are $22,000 (roughly 4.4% of $500,000).

-

Without Concession: You would need to pay $22,000 in cash at closing (plus your down payment).

-

With $20,000 Concession: You would only need to pay $2,000 in cash for closing costs (plus your down payment).

-

Savings: That's a huge upfront saving of $20,000 in cash!

-

-

-

Preserves Savings/Emergency Fund: By reducing your upfront costs, you keep more of your savings liquid, which is crucial for unexpected home repairs or financial emergencies after you move in.

-

Potentially Easier to Qualify for the Loan (in some cases): While your loan amount is higher, having more cash on hand can make your financial picture look stronger to lenders, especially if your down payment isn't substantial.

Cons:

-

Higher Monthly Mortgage Payments: Since your loan amount remains at $500,000, your monthly principal and interest payment will be higher compared to the reduced price scenario.

-

Numeric Example:

-

Original Loan ($500,000): As calculated before, your principal and interest payment would be approximately $3,326 per month.

-

Vs. Reduced Loan ($480,000): This is $133 more per month than if you had negotiated a price reduction.

-

-

-

More Interest Paid Over the Life of the Loan: This higher monthly payment translates to paying significantly more interest over the 30-year term.

-

Numeric Example: Over 30 years, paying on a $500,000 loan instead of a $480,000 loan means you'll pay an additional $47,880 in interest.

-

-

No Impact on Property Taxes: Since the purchase price remains $500,000, your property tax assessment will likely be based on that higher value, meaning no potential for tax savings here.

-

Less Equity from Day One: You're paying the full $500,000 for the house, meaning your initial equity position is based on that higher price point, assuming the same down payment.

Which Option is Right for You?

The best option largely depends on your personal financial situation and priorities.

-

Choose a Lower Listing Price if:

-

You have ample cash saved for closing costs and prefer lower monthly payments.

-

You plan to stay in the home for a long time and want to minimize the total interest paid.

-

You want the long-term benefit of potentially lower property taxes and increased equity.

-

- Choose a Closing Cost Concession if:

-

You are trying to minimize the cash you need to bring to closing and want to preserve your savings.

-

You are stretching your budget to afford the home and the upfront costs are a major hurdle.

-

You anticipate having higher cash flow later and are less concerned about slightly higher monthly payments in the short term.

-

The Secret Third Option

Using the $20,000 concession to buy down your interest rate is often considered the "secret third option" that combines the benefits of both a price reduction and a closing cost credit.

When you use a concession for a buydown, you are essentially "pre-paying" interest to the lender in exchange for a lower interest rate. This can be done in two ways: Permanently (for the life of the loan) or Temporarily (a steep discount for the first 1–3 years).

Option 3: The Permanent Rate Buydown

In this scenario, you use the $20,000 to buy "discount points." Typically, 1 point costs 1% of the loan amount and lowers your rate by about 0.25%.

The Numbers: On a $400,000 loan (assuming a 20% down payment on a $500,000 house), $20,000 represents 5 points. This could drop your interest rate by roughly 1.25%.

Feature Standard Rate (7%) With 5-Point Buydown (5.75%)

Loan Amount $400,000 $400,000

Monthly P&I\ $2,661 $2,344

Monthly Savings - $327

30 Yr Savings - $117,720

-

Pros: Huge monthly savings ($327 vs. $133 for a price drop) and massive long-term interest savings.

-

Cons: You lose the money if you refinance or sell the house too early (e.g., within 3–5 years).

Option 4: The Temporary "2-1 Buydown"

This is very popular when rates are high. The $20,000 credit sits in an escrow account and subsidizes your payment: your rate is 2% lower the first year and 1% lower the second year.

The Numbers (Starting at 7%):

-

Year 1: You pay a 5% rate (~$2,147/mo). Savings: $514/mo.

-

Year 2: You pay a 6% rate (~$2,398/mo). Savings: $263/mo.

-

Year 3-30: You pay the full 7% rate ($2,661/mo).

-

Pros: Extreme "breathing room" during your first two years of homeownership (great for buying furniture or making repairs). If you refinance in year 2, many lenders will apply the remaining "unused" escrow funds toward your principal.

-

Cons: Your payment will eventually jump back up to the full market rate.

Summary Table: Which $20,000 Move Wins?

Startegy Upfront Cash Saved Monthly Savings 30 Yr Total Value Best if......

Price Drop $0 - $133 -$48,000 You want 'safe' long-term equity

Closing Credit $20,000 $0 $20,000 You are cash-poor

Permanent Buydown on Interest $0 $327 - $117,000 You'll keep this loan for 10+ years

2-1 Rate Buydown $0 - $514 yr 1 - $12,000 You expect to refinance in 2 yrs

Strategic Takeaways

-

The 5-Year Rule: If you plan on moving or refinancning within 5 years, do not buy down the rate. Take the Closing Cost Credit instead. You get the full $20,000 value on day one.

-

The "Forever Home" Strategy: If this is your long-term home, the Rate Buydown is the undisputed champion. By Year 10, you will have saved nearly $40,000 ($327 $\times$ 120 months), which is double the initial value of the concession.

-

The Refinance Gamble: Many experts predict interest rates may drop in the next 12–24 months. If you buy down your rate to 5.75% today, but market rates drop to 5% next year, you will likely want to refinance. If you do, that $20,000 "investment" vanishes instantly.

Recent Posts