Mortgage Myths Debunked for Homebuyers

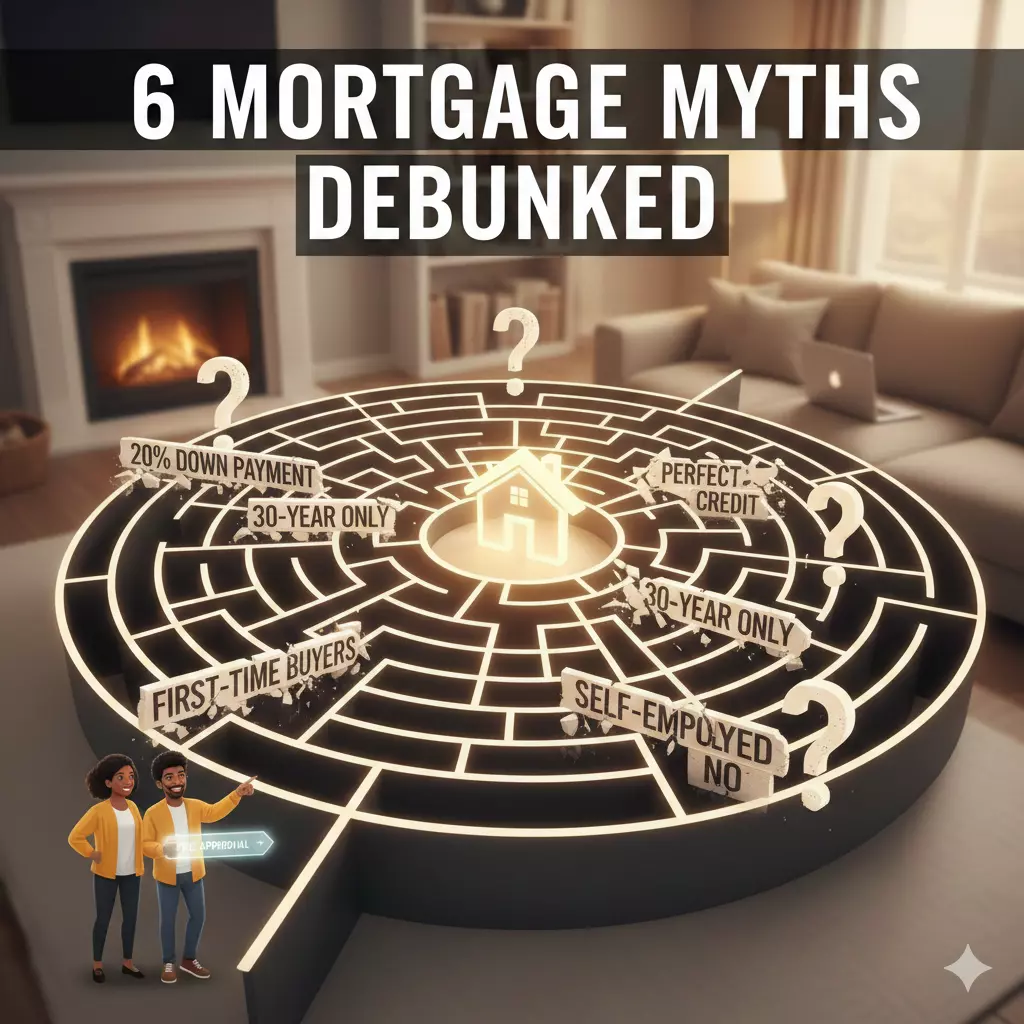

For many, the path to homeownership feels less like a straight line and more like a maze filled with outdated advice and "common knowledge" that doesn't actually hold up under scrutiny. Whether you are a first-time buyer or looking to move up, the mortgage process can feel daunting—especially if you’re operating on information that is simply untrue.

To help you navigate the market with confidence, let’s clear the air and debunk six mortgage myths that continue to haunt today’s homebuyers.

1. Pre-Qualification and Pre-Approval are the Same

Many buyers use these terms interchangeably, but in the eyes of a seller, they are worlds apart.

-

Pre-qualification is a "napkin sketch" of your finances. It’s based on unverified information you provide to a lender. It gives you a ballpark figure of what you might afford, but it carries little weight in a negotiation.

-

Pre-approval is the real deal. The lender verifies your income, taxes, and credit history. A pre-approval letter tells a seller you are a serious, vetted buyer who has the financial backing to close the deal. In a competitive market, a pre-approval isn't just a bonus—it’s a requirement.

2. You Need an Excellent Credit Score To Qualify

While a "perfect" 800+ credit score will certainly land you the lowest possible interest rates, it is far from a requirement for homeownership.

The reality is that mortgage programs exist for a wide range of credit profiles. For example, FHA loans often allow for scores as low as 580 (and sometimes lower with a larger down payment). Even conventional loans have become more flexible. Having a lower score might mean a slightly higher interest rate or higher private mortgage insurance (PMI) premiums, but it doesn't automatically disqualify you from owning a home.

3. You Should Always Aim for a 30-Year Fixed Mortgage

The 30-year fixed-rate mortgage is the "Goldilocks" of the industry—it’s safe, predictable, and familiar. However, "safe" doesn’t always mean "best."

If you plan on living in your home for only five to seven years, a 5/1 or 7/1 Adjustable-Rate Mortgage (ARM) might offer a significantly lower interest rate during that initial period, saving you thousands. Alternatively, if you can afford higher monthly payments, a 15-year fixed mortgage allows you to build equity twice as fast and pay tens of thousands of dollars less in total interest over the life of the loan. Always match your loan term to your actual life plans.

4. You Need To Put 20% Down

This is perhaps the most persistent myth in real estate. While a 20% down payment allows you to avoid Private Mortgage Insurance (PMI), it is not a legal or standard requirement for most buyers.

In fact, the median down payment for first-time buyers is often closer to 6% to 7%. Many conventional loans allow for as little as 3% down, and FHA loans require only 3.5%. If you are a Veteran or buying in a qualifying rural area, you might even be eligible for 0% down through VA or USDA programs. Waiting until you have 20% could mean missing out on years of equity growth while home prices continue to rise.

5. Only First-Time Buyers Qualify for VA Loans

There is a common misunderstanding that the VA loan is a "one-and-done" benefit for those just starting out. This couldn't be further from the truth.

The VA loan benefit is a lifetime entitlement. Eligible veterans and active-duty service members can use it to buy their first home, sell that home and use the benefit again for a second home, or even hold two VA loans simultaneously in certain circumstances. Furthermore, there is no "first-time buyer" requirement; you can be a seasoned real estate investor or a retiree and still utilize the incredible 0% down benefits of the VA program.

6. You Can’t Get a Mortgage If You’re Self-Employed

The "gig economy" and the rise of entrepreneurship have changed the workforce, but many believe lenders still only want to see a traditional W-2.

While it’s true that self-employed borrowers have to jump through a few more hoops—specifically providing two years of tax returns and a year-to-date profit and loss statement—getting a mortgage is entirely possible. Lenders just want to see stability. If you can prove a consistent stream of income and a healthy business, you are just as qualified as someone with a corporate desk job. There are even "bank statement loans" specifically designed for business owners that use deposits rather than tax returns to qualify.

The Bottom Line

The mortgage landscape is more flexible than most people realize. Myths about 20% down payments or perfect credit scores often keep qualified buyers on the sidelines for years. By understanding the actual requirements and the variety of loan products available, you can stop waiting and start building equity.

Recent Posts