Evaluating a New Construction Home: Your Guide to Long-Term Value

Buying a brand-new home comes with incredible advantages: modern design, fresh amenities, and the peace of mind that everything is untouched and under warranty. As a Utah real estate professional, I know that new construction homes are highly desirable. However, to ensure you are securing the best long-term value, it's essential to look beyond the model home's perfect staging and evaluate the purchase with a critical eye.

This guide expands on the most crucial factors you must consider when evaluating a new construction property, turning your excitement into a strategic investment.

1. Research the Builder's Reputation and Track Record

The quality of your home is a direct reflection of the company that built it. While a shiny new community may look impressive, a builder's reputation and past performance are non-negotiable considerations.

-

Past Projects and Reviews: Research the builder's previous communities. Look up reviews on independent sites, check the local Better Business Bureau (BBB), and, ideally, speak with current homeowners in their recently completed developments. Ask specifically about the builder's responsiveness to warranty issues and the overall quality of their finish work.

-

A Solid Track Record Matters: A builder with a long-standing history of high-quality construction and excellent customer service is a safer bet than a brand-new or heavily criticized company. You are looking for a history of building homes that stand the test of time, not just ones that look good on closing day.

2. Clarify Included Features vs. Costly Upgrades

Model homes are sales tools, and they are usually packed with every available upgrade the builder offers—from high-end flooring to gourmet appliance packages. This can create a misleading perception of what's included in the base price.

-

The Model Home Illusion: What you see in the model home is often not what you get. The upgraded features contribute significantly to the perceived value and aesthetic appeal.

-

Ask for the Standards List: Before signing a contract, get a detailed list that clearly outlines what is standard (included in the base price) and what is an upgrade (an extra cost). This applies to everything from cabinet hardware and counter materials to energy-efficient windows and landscaping packages. Clarifying this upfront prevents surprise costs that can quickly inflate your budget.

3. Understand the Construction Timeline and Delays

Construction is subject to numerous variables, including material availability, labor shortages, and weather delays. A clear understanding of the timeline and the remedies for potential delays is vital, especially if you have a tight deadline for moving out of your current residence.

-

Estimated Completion Dates: Get an estimated completion date in writing. More importantly, understand what provisions are in the contract regarding delays.

-

Contingency Planning: Ask your real estate agent to review the contract language regarding construction delays. What is the builder’s policy if the completion is pushed back by weeks or even months? This protects you from unexpected housing and moving costs.

4. Scrutinize Foundation Quality in Utah's Unique Environment

In certain geographic areas like Utah, specific geological factors make foundation quality exceptionally important. Our region's expanding soils and freeze-thaw cycles can put significant stress on a home's foundation.

-

Soil Reports and Structural Engineering: Do not take foundation quality for granted. Ask the builder for the soil reports and documentation from the structural engineer confirming that the foundation design accounts for local soil conditions.

-

Structural Warranties: Seek clarification on the builder’s structural warranty, especially regarding the foundation. A robust, long-term structural warranty (e.g., 10+ years) is critical for protecting your investment against major structural shifts.

5. Do Not Skip the Home Inspection—Hire an Independent Inspector

Many new home buyers assume a brand-new home doesn't need an inspection. This is a costly mistake. Builder quality control, while often good, is not infallible. Even new homes can have issues ranging from improper electrical wiring and plumbing leaks to inadequate insulation or roof problems.

-

Independent, Third-Party Review: Hire a licensed, independent home inspector. Their loyalty is to you, not the builder. They should be experienced in new construction and can spot issues that must be addressed before closing.

-

The Pre-Drywall Inspection: Ideally, your contract should allow for at least two inspections: one before the drywall goes up (to check framing, wiring, and plumbing) and a final inspection before closing. It is much easier for the builder to correct deficiencies before they are covered up.

6. Clarify Warranty Coverage

One of the great benefits of new construction is the included builder warranty. However, not all warranties are created equal.

-

What is Covered? Get a clear document outlining the warranty's coverage and duration. Typical structures include:

-

1-Year Coverage: For workmanship and materials (e.g., drywall, paint, trim).

-

2-Year Coverage: For major systems (e.g., plumbing, electrical, HVAC).

-

10-Year Coverage: For major structural defects (e.g., foundation, load-bearing walls).

-

-

The Claims Process: Understand the process for filing a claim and the builder's required response time for repairs.

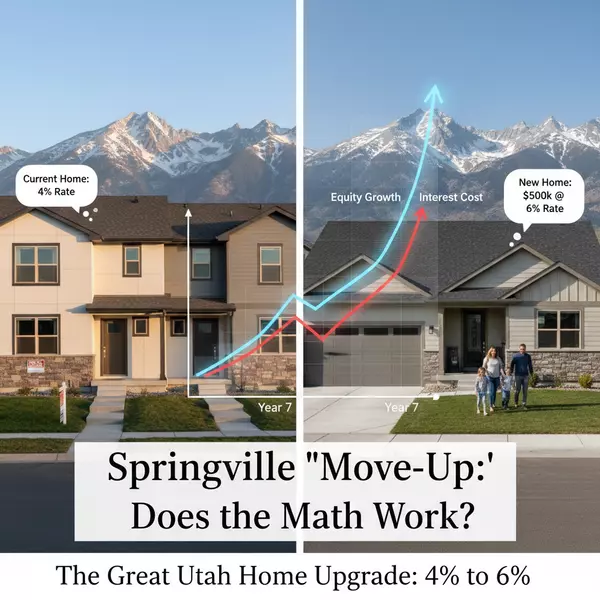

7. Explore Builder-Offered Loan Programs

Builders often work with preferred lenders to offer incentives that can save you significant money, especially in today's market.

-

Rate Buydowns and Closing Costs: Ask the builder about available incentives, such as assistance with closing costs, or a rate-reduced mortgage program (like a 2-1 temporary buydown). These programs can make your new home significantly more affordable in the initial years.

A new construction home can be a fantastic investment, offering a fresh start and customized living.

For someone looking at a new construction home, hiring a personal real estate agent is crucial because the agent provides unbiased advocacy by scrutinizing the builder's contract and negotiating incentives that benefit the buyer, not the developer. A buyer's agent also ensures the buyer has an expert to evaluate the home's condition and build quality, which the builder's own sales team is not obligated to do.

The person working for the new home construction project (the on-site sales agent) has a fiduciary duty to the builder/developer, meaning they are legally obligated to act in the best financial interest of their employer. Your realtor has a fiduciary duty to YOU!

By asking these critical questions and partnering with an experienced real estate agent to navigate the contract, you ensure that the long-term value of your home lives up to its initial promise.

Recent Posts