Beyond the Mortgage: How to Truly Calculate Your 'Dream Home' Budget (Without Going Broke)

Buying a home is one of the most significant financial moves you’ll ever make. Before you fall in love with a kitchen island or a backyard view, you need to answer the most important question: "How much house can I actually afford?"

While a lender might approve you for a certain amount, that doesn't always mean it fits your lifestyle. This is where home affordability calculators come in. This guide will walk you through how to use them, why they matter, and the best tools to start your journey.

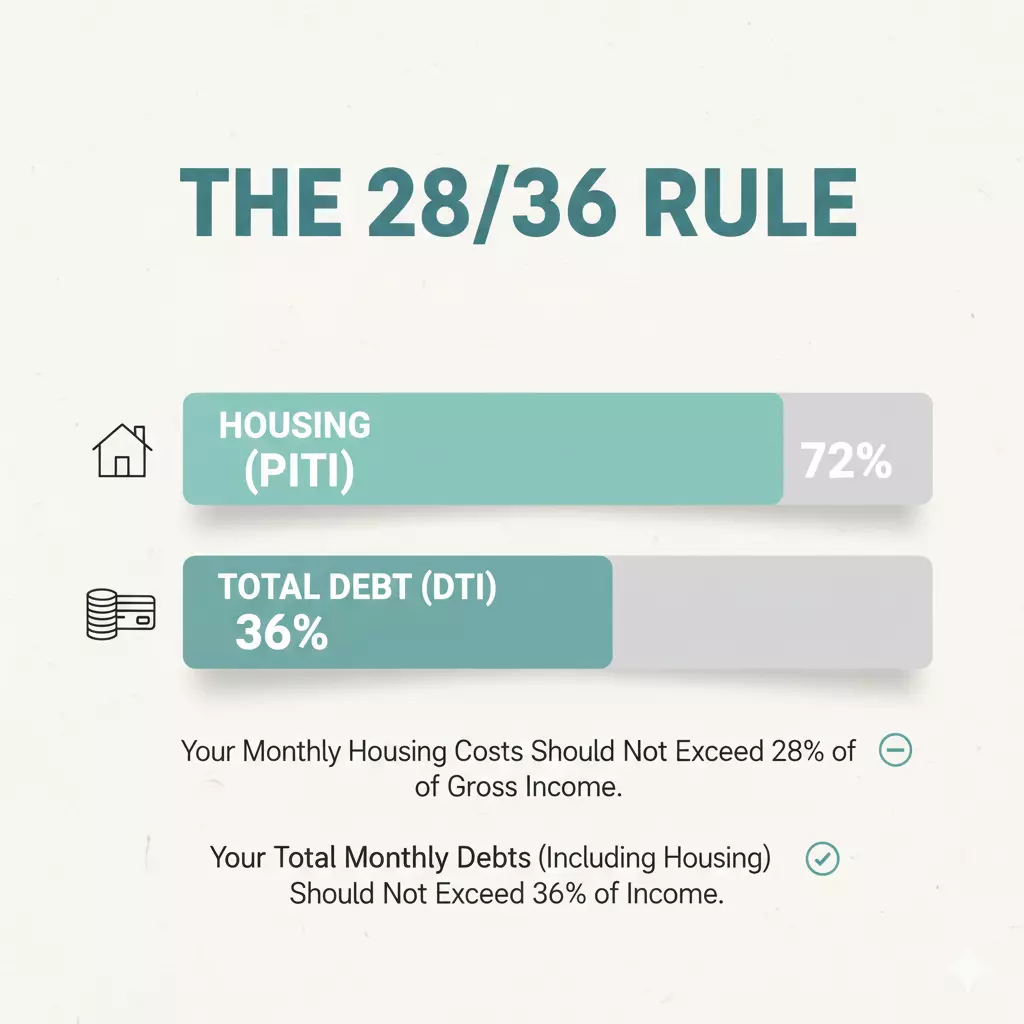

1. How Affordability is Calculated: The "28/36 Rule"

Most calculators use two primary formulas to determine your "buying power." Understanding these helps you input the right data.

-

The 28% Rule (Front-End Ratio): This suggests that your total housing costs (mortgage, taxes, insurance, and HOA) should not exceed 28% of your gross monthly income (before taxes).

-

The 36% Rule (Back-End Ratio): This suggests that your total debt—including your new mortgage PLUS car loans, student loans, and credit card payments—should stay below 36% of your gross income.

Example Calculation

If you and your partner earn a combined $120,000 per year:

-

Monthly Gross Income: $10,000

-

Housing Limit (28%): $2,800/month

-

Total Debt Limit (36%): $3,600/month

If you already have $800 in car and student loan payments, you are right at the 36% limit ($2,800 + $800 = $3,600).

2. Why Use an Affordability Calculator?

The Benefits:

-

Sets Realistic Expectations: It prevents "heartbreak" by narrowing your search to homes within your actual budget.

-

Scenario Planning: You can see how a $50,000 higher down payment or a 1% drop in interest rates changes your monthly payment.

-

Holistic View: Good calculators factor in the "hidden" costs like property taxes and homeowners insurance, which can vary wildly by zip code.

3. Top Recommended Websites

Not all calculators are created equal. Here are four of the best for 2026:

| Website | Best For... | Key Feature |

| Zillow | Visual Browsing | Connects your budget directly to active home listings in your area. |

| SmartAsset | Detailed Accuracy |

Includes a "holistic" view of closing costs and local tax data. |

| NerdWallet | Simple Interface | Great for beginners; provides "Conservative" vs. "Aggressive" budget tiers. |

| Bankrate | Market Realism | Automatically pulls in real-time interest rates based on your credit score. |

4. Pros and Cons of Online Calculators

Pros

-

Instant Results: Get a baseline number in seconds without talking to a loan officer.

-

Privacy: Explore your financial limits without a "hard pull" on your credit report.

-

Empowerment: You go into the bank knowing your numbers, making you a stronger negotiator.

Cons

-

Oversimplification: They often miss personal costs like childcare, groceries, or travel habits.

-

The "Bank's View": Most calculators tell you what a bank will lend you, not necessarily what you should spend to maintain your lifestyle.

-

Outdated Rates: Unless they pull live data, the interest rate might be off by 0.5%—which can mean hundreds of dollars a month.

5. How to Get the Most Accurate Result

To use these tools effectively, don't just guess the numbers. Have these ready:

-

Gross Annual Income: Your total salary before taxes.

-

Monthly Debt: Minimum payments for all recurring loans.

-

Down Payment: The cash you have ready (don't forget to keep an emergency fund separate!).

-

Credit Score: A rough estimate (e.g., 740+) to get an accurate interest rate.

Pro Tip: Always run a "Stress Test." If the calculator says you can afford $3,000 a month, try living on that budget for three months (put the extra money into savings). If it feels too tight, lower your home price target.

The "Real Cost" Home Comparison Template

This template is designed for a spreadsheet (Excel or Google Sheets).

Section 1: The Upfront "Cash Out"

These are the funds you need in your bank account before you get the keys.

| Expense Item | Description | Example / Formula |

| Home Purchase Price | The agreed-upon sale price. | $450,000 |

| Down Payment % | Percent of price (3.5%, 5%, 20%). | 10% |

| Down Payment $ | Total cash for the down payment. | $45,000 |

| Closing Costs | Lender fees, title, and taxes. | 2-5% of price ($9,000 - $22,500) |

| Home Inspection | Critical pre-purchase health check. | $400 - $700 |

| Immediate Repairs | Painting, locks, or urgent fixes. | $2,000 (Estimate) |

| TOTAL CASH NEEDED | (Down Pmt + Closing + Inspection + Repairs) | $56,400+ |

Section 2: The Monthly "P.I.T.I.+"

The bank looks at PITI, but you should look at PITI + Lifestyle.

| Expense Item | Calculation Tips | Monthly Cost |

| Principal & Interest | Use a calculator with current rates. | $2,400 |

| Property Taxes | Annual tax ÷ 12 (Check Zillow/Redfin). | $400 |

| Home Insurance | Get a quote or estimate 0.5% of value. | $150 |

| PMI | Required if down payment < 20%. | $100 - $200 |

| HOA Fees | Neighborhood or condo association. | $50 |

| Maintenance Fund | Rule of Thumb: 1% of home value ÷ 12. | $375 |

| Utilities | Electric, gas, water, trash, internet. | $300 |

| MONTHLY TOTAL | Your true cost of living. | $3,825 |

Section 3: The Reality Check (Ratios)

Use these formulas to see if the house is "Safe," a "Stretch," or "Dangerous."

-

Front-End Ratio: $(Monthly PITI \div Gross Monthly Income) \times 100$

-

Goal: Under 28%

-

-

Back-End Ratio (DTI): $(Total Debts + PITI \div Gross Monthly Income) \times 100$

-

Goal: Under 36%

-

-

The "Vibe" Check: Subtract your Monthly Total from your Take-Home Pay. Do you have enough left for groceries, gas, and fun?

Pro-Tip: The "1% Rule"

If the home is worth $400,000, they should save $4,000 a year ($333/month) for the inevitable day the water heater leaks or the AC needs a tune-up. This "hidden" line item is the difference between a happy homeowner and a stressed one.

🏠 The Hidden Costs of Homeownership: A Checklist

Don't let your "Dream Home" become a "Debt Trap." Ensure you've budgeted for these often-overlooked expenses.

1. The "Day One" Expenses (One-Time)

-

[ ] Utility Deposits: If you are moving to a new area, providers may require a deposit to turn on electricity, water, or gas.

-

[ ] Lock Rekeying: For security, you’ll want to change every exterior lock immediately ($150–$300).

-

[ ] Window Treatments: It’s surprising how many homes are sold without blinds or curtains ($500–$2,000+).

-

[ ] Moving Logistics: Truck rentals, professional movers, packing tape, and boxes ($500–$5,000).

2. Annual "Must-Haves" (Recurring)

-

[ ] Property Tax Hikes: Remember that taxes often jump the year after a sale because the home is reassessed at its new, higher value.

-

[ ] Supplemental Insurance: Standard policies often exclude flood, earthquake, or sewer backup coverage.

-

[ ] Pest Control: Quarterly sprays to keep ants, termites, or rodents at bay ($300–$600/year).

-

[ ] Gutter & HVAC Service: Annual cleanings and tune-ups to prevent $10,000 disasters later.

3. The "Cost of Convenience" (Lifestyle)

-

[ ] Lawn & Landscaping: If you don't own a mower, you'll need to buy one—or hire a service ($100–$200/month).

-

[ ] Snow Removal: Depending on your region, you may need a blower, salt, or a plow service.

-

[ ] HOA Special Assessments: Occasionally, an HOA may charge a one-time fee for major neighborhood repairs (roofs, pools, or roads).

4. The "1% Rule" Fund

-

[ ] Emergency Repair Savings: Set aside 1% of the home's value annually.

Example: On a $400,000 home, keep $4,000 in a high-yield savings account specifically for the "Big Three": The Roof, the HVAC, and the Water Heater.

Why this matters for affordability:

If a buyer's "Affordability Calculator" says they can spend $2,500 a month, but they haven't factored in $300 for utilities and $200 for a maintenance fund, they are actually $500 over budget before they even buy groceries.

Recent Posts